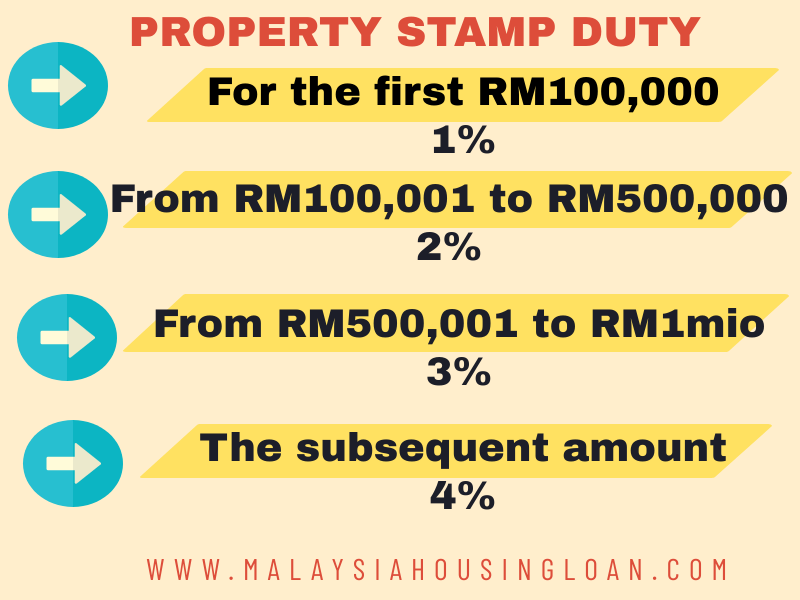

stamp duty malaysia 2018

ASCII characters only characters found on a standard US keyboard. 4250 housing units worth RM358mil will be built under the Rumah Mesra Rakyat program.

Proposed Ad Valorem Stamp Duty To Be Paid When Contract Signed Publication By Hhq Law Firm In Kl Malaysia

2018 Canada War Amps 1918-2018 Special Event Cover Veterans Children Amputees.

. And 2Participating Organisations Trading Manual Trading Manual Consequential to the Repeal of the Goods and Services Tax GST Pursuant to the Goods and Services Tax Repeal Act 2018 GST Repeal Act Annexure 1 Rule Amendments. Items may be opened on sides have sealed flaps tears folds scuffs gouges or stamp damage. Stamp duty exemption on contract notes for sale and purchase transaction of structured warrant or exchange-traded fund approved by the Securities Commission executed from 1 January 2018 to 31 December 2025.

Get information on latest national and international events more. Ahmad Zahid Hamidis former press secretary tells the High Court the stamp was used to affix the former home ministers signature on certificates and invitation cards. Read latest breaking news updates and headlines.

You should pay both BSD and ABSD using the same form named Buyers Stamp Duty and. Calculating the stamp duty amount for your tenancy agreement isnt that hard. I am an SC owning one house in Malaysia but none in Singapore.

Large 41 mm steel case. CANADA 2018 3104a P Astronomy booklet Mint NH. Find many great new used options and get the best deals for Canada Stamp 57 Mint Never Hinged at the best online prices at eBay.

C 1177 C 125 shipping C 125 shipping C 125 shipping. The Tenancy Agreement must be stamped by LHDN and put into effect by or after January 2018. The system is thus based on the taxpayers ability to pay.

Rare collectible rarity in perfect condition Service 2018 Extremely rare collectors watch from Omega. Items may be opened on sides have sealed flaps tears folds scuffs gouges or stamp damage. There are also differences between tax exemptions tax reliefs tax rebates and tax deductibles so make.

This means that low-income earners are imposed with a lower tax rate compared to those with a higher income. 1Rules and Directives of Bursa Malaysia Securities Berhad BMS Rules and Directives. Get 247 customer support help when you place a homework help service order with us.

The stamp duty for sale and purchase agreements and loan agreements are determined by the Stamp Act 1949 and Finance Act 2018The latest stamp duty scale will apply to loan agreements dated 1 January 2019 or later and to sale and purchase agreements and instruments of transfer dated 1 July or later. If you are looking for VIP Independnet Escorts in Aerocity and Call Girls at best price then call us. C 1177 C 125 shipping C 125 shipping C 125 shipping.

The steel bracelet is also original from the time and. Iran Air Flight 655 was a scheduled passenger flight from Tehran to Dubai via Bandar Abbas that was shot down on 3 July 1988 by two SM-2MR surface-to-air missiles fired by the USS Vincennes a guided-missile cruiser of the United States NavyThe aircraft an Airbus A300 was destroyed and all 290 people on board were killed. Find many great new used options and get the best deals for DR WHO 1897 CANADA TORONTO ONT TO USA i09969 at the best online prices at eBay.

B 4862022 - notification under subregulation 33 for the purpose of by-election for the seat of the state legislative assembly n66 bugaya in the state of sabah. Free shipping for many products. Is ABSD payable when I buy my first residential property in Singapore.

Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. A value-added tax VAT known in some countries as a goods and services tax GST is a type of tax that is assessed incrementally. Free shipping for many products.

A concessional rate applies to homes valued between 430000 and 530000. Free shipping for many products. It is levied on the price of a product or service at each stage of production distribution or sale to the end consumer.

There is a maximum period of three 3 consecutive years of. 6 to 30 characters long. How To Calculate Stamp Duty In Malaysia.

Seamaster Chronostop model reference 145008. Find many great new used options and get the best deals for ILLUSTRATED FDC - 1984 - NATIONAL PARK - 934 - GLACIER 100 - OTTAWA ONTARIO at the best online prices at eBay. Year of manufacture 1969.

Wherever you decide to live youll need some help along the way. Average rate in years 20132018 according to List of countries by real GDP growth rate data mainly from the World Bank. If the ultimate consumer is a business that collects and pays to the government VAT on its products or services it can reclaim the tax paid.

2018 Canada War Amps 1918-2018 Special Event Cover Veterans Children Amputees. Feel free to use our calculators below. ABSD Rates from 12 Jan 2013 to 5 Jul 2018 ABSD Rates from 6 Jul 2018 to 15 Dec 2021 ABSD Rates on or after 16 Dec 2021.

Similarly you wont have to pay stamp duty on land valued at less than 300000 and a concessional rate applies to land valued between 300000 and 400000. The 100 stamp duty exemption for first-time homeowners remains applicable for properties priced RM500000 and below through the Keluarga Malaysia Home Ownership Initiative i-Miliki initiative from June 1 2022 to December 2023. All you need is a simple formula which you can refer to here.

In Western Australia first-home buyers do not have to pay any stamp duty on homes valued at less than 430000. Returns are always accepted if condition is worse than expected. The jet was hit while flying over Irans territorial waters.

Returns are always accepted if condition is worse than expected. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Tamil News Tamil Newspaper Latest Tamil news - Dailythanthi.

Must contain at least 4 different symbols. Find out how to get a mortgage for an overseas propertyYou will also need to find a trusted provider to transfer your money overseasIf youre aiming to get on the property ladder in the UK check out our guide for first-time buyers for advice and tips on all the help that is available to you. Stamp duty exemption on Perlindungan Tenang insurance policies and takaful certificates with a yearly premium contribution.

Aerocity Escorts 9831443300 provides the best Escort Service in Aerocity.

Stamp Duty Malaysia 2022 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Tenancy Agreement In Malaysia Complete Guide And Sample Download

Stamp Duty Formula For Tenancy Agreement In Malaysia Mylegalweb

Business Sale Agreement Is Subject To Nominal Stamp Duty International Tax Review

Stamp Duty For Transfer Of Properties In Malaysia

First Time Home Buyer Stamp Duty Exemption Malaysia 2018 Lucarkc

Property Law In Malaysia Stamp Duty For Transfer Of Property Chia Lee Associates

Exemption Of Stamp Duty On Contract Notes For Transactions Of Exchange Traded Funds And Structured Warrants Over Three Years From Jan 2018 The Edge Markets

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

My Publications Far East Organization Artwork Page 2 Created With Publitas Com

Stamp Duty Imposed For Transfer Of Properties In Malaysia By Tyh Co

Stamp Duty And Administration Fee 2 Important Aspects For Tenancy Agreement In Malaysia

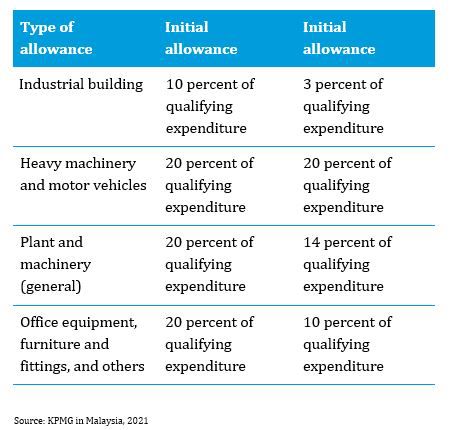

Malaysia Taxation Of Cross Border M A Kpmg Global

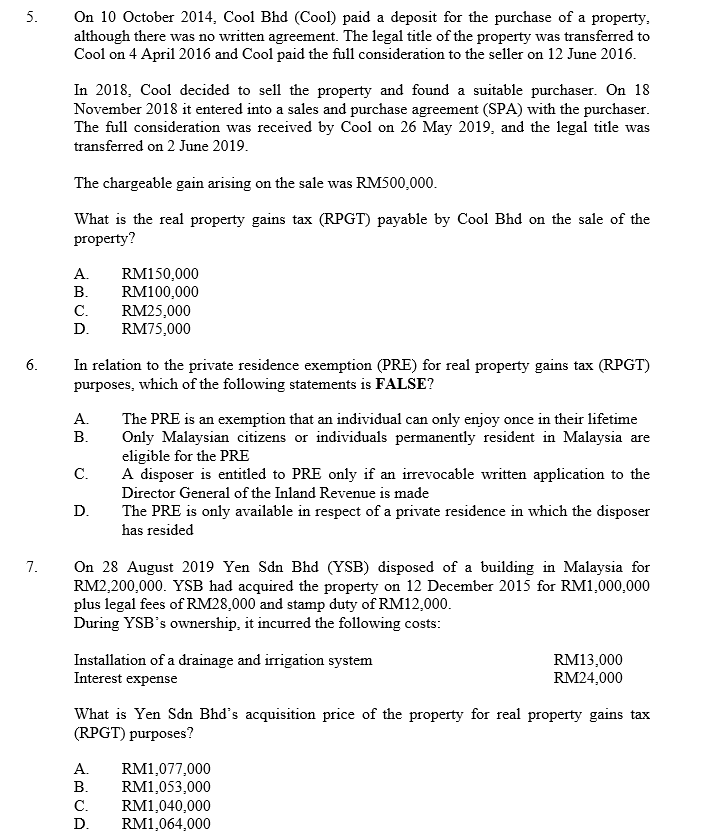

Solved 5 On 10 October 2014 Cool Bhd Cool Paid A Deposit Chegg Com

Solved Question 1 Encik Suhaimi A Malaysian Citizen Sold A Chegg Com

Comments

Post a Comment